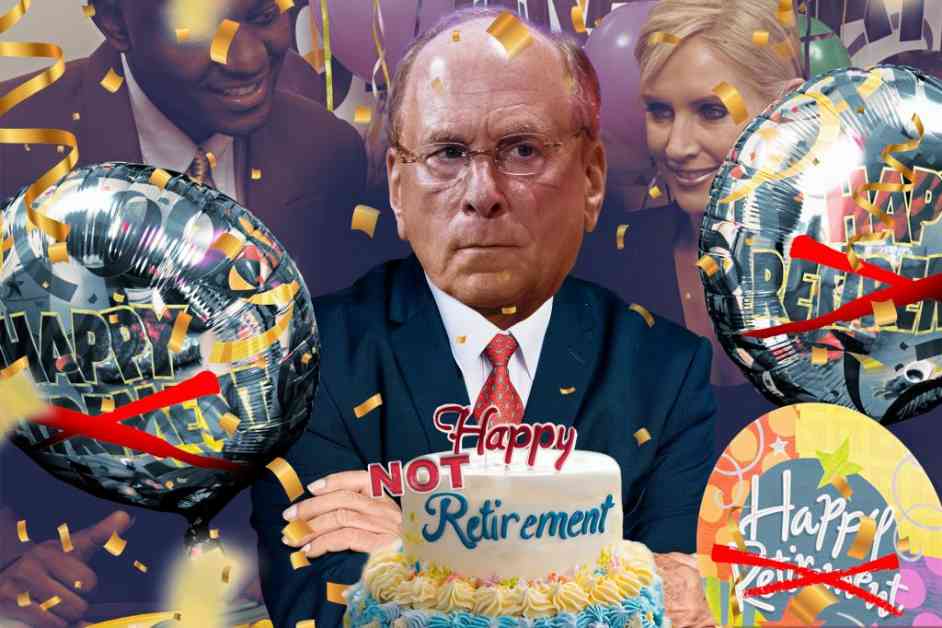

Larry Fink, the CEO and founder of BlackRock, the world’s largest asset-management firm, is a figure that Wall Street has long speculated about. The burning question remains: When will Fink retire? The surprising answer: Never, at least not anytime soon, if Fink has his way.

Fink has recently communicated to his top executives his intention to remain at the helm for the foreseeable future. This decision comes on the heels of BlackRock’s strategic acquisitions totaling a staggering $28 billion in the past year. These acquisitions are part of BlackRock’s grand plan to diversify its investment portfolio beyond traditional approaches and cater to the evolving needs of its clients.

The 72-year-old CEO, known for his boundless energy and vitality that belies his age, has no plans to step down, leaving his potential successors in a state of uncertainty. Mark Wiedman, the managing director of BlackRock’s global client business and a frontrunner for the CEO position, recently announced his departure after nearly two decades with the firm. The 54-year-old Wiedman’s exit underscores Fink’s resolve to continue leading the company he built from the ground up.

Succession planning at BlackRock is a topic frequently discussed by the board, yet the company’s future direction remains closely tied to Fink’s vision. BlackRock, which Fink founded in 1988 after a tumultuous exit from First Boston Corp., has grown exponentially under his leadership. The firm’s market value now stands at $150 billion, managing an impressive $11.6 trillion in assets.

Stephen Schwarzman, the co-founder of Blackstone Group, where BlackRock was initially incubated, once lamented letting Fink leave, calling it “the biggest mistake” of his career. The rivalry between BlackRock and Blackstone, intensified by the recent acquisitions, paints a picture of two financial giants vying for market dominance.

While Blackstone has long been synonymous with private equity, BlackRock has ventured into uncharted territory by expanding its private credit offerings. With acquisitions like HP Partners, BlackRock has positioned itself as a formidable competitor to Blackstone, encroaching on its domain.

The narrative of Larry Fink, often associated with Environmental, Social, and Governance (ESG) investing, has taken a slight shift amid political pressures. Fink, once a vocal advocate of ESG principles, has faced backlash from conservative politicians in the US. This criticism, coupled with strategic lobbying efforts, has prompted Fink to recalibrate his stance on ESG investing.

Amidst these challenges, BlackRock’s financial performance remains robust, with Fink eyeing new opportunities in emerging sectors like crypto ETFs. The competition with Schwarzman, his former mentor turned rival, adds an intriguing layer to Fink’s enduring legacy.

As the industry speculates about Fink’s retirement plans, the man himself seems content to remain at the helm. With a zest for innovation and a keen eye for strategic growth, Fink’s journey as a financial titan continues to captivate observers worldwide. And with colleagues affirming that he’s simply “having too much fun,” retirement seems like a distant thought for the indefatigable Larry Fink.